Just like any electronic data interchange system, the IRS 1099 E-File service requires 1099 forms data to be formatted in a special way in order to be processed and validated properly. This "special way" is called the 1099 E-File format or 1099 electronic filing specification. This page describes the layout and file structure of a 1099 E-File submission. Please note that the regular business filer does not have to thoroughly understand how the 1099 data is formatted and can simply rely on software programs to create IRS-compliant submissions.

Our W2 Mate software creates unlimited IRS-compliant 1099 E-File submissions ready to send to the federal government and most state tax departments. Click here to learn more about W2 Mate software.

The 1099 E-File format is a text-based file that includes a group of fixed-width lines, with each line representing recipient, submitter or 1099 return data such as amounts, dates, addresses and state information.

Since 1099 electronic filing format is text-based, 1099 filers can use any text viewer or editor in order to see the "raw" contents of a 1099 EFile submission. The most popular text editor is notepad which comes built-in with the Windows operating system (simply type "notepad" in the Windows Start Menu Search Box). Other popular free text editors include WordPad, Notepad++, TextWrangler (Mac) and "Google Docs" (web-based, cross platform).

If you want to display the data in a 1099 E-File submission as 1099 forms (rather than "raw" or encoded text) you will need to use software that can import the 1099 E-File submission, decode it and display the form data in the correct boxes. You can use the trial version of our W2 Mate software to achieve just that: Once you have the software installed click "Import Data > From 1099 Electronic Filing Format (Publication 1220 Format) ".

You can get the latest 1099 e-file specification from the IRS website by following this link. You can also go to www.irs.gov and search for "Filing Information Returns Electronically". Please note that the same specification is scattered all over the internet on PDF and book download websites, please be very careful not to get your copy from any of these sites since it's outdated in most cases and includes embedded marketing information that is both confusing and inaccurate. Remember that you can always call the IRS at 866-455-7438 and they will send you the latest specification or show you how to download online.

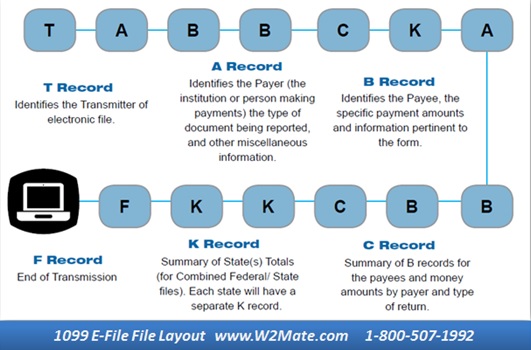

Please refer to the diagram above. A typical 1099 EFile should have the following records:

Transmitter "T" Record : Identifies the Transmitter of electronic file.

Payer "A" Record : Identifies the Payer (the institution or person making payments) the type of document being reported, and other miscellaneous information.

Payee "B" Record : Identifies the Payee, the specific payment amounts and information pertinent to the form.

End of Payer "C" Record : Summary of B records for the payees and money amounts by payer and type of return.

State Totals "K" Record : Summary of State(s) Totals (for Combined Federal/ State files). Each state will have a separate K record.

End of Transmission "F" Record : End of Transmission.

© Copyright 2014 Real Business Solutions. All Rights Reserved. Please review our privacy statement and terms of use. Uninstall Instructions