1099 E-File for Sage 50 (Peachtree) including software, free downloads and instructions. Support for 1099 Miscellaneous, Interest, Dividends, Real Estate, Retirement , Tuition, Mortgage Interest, Merchant Card, Cancellation of Debt, Barter, Acquisition of Secured Property and other 1099s.

Our W2 Mate software is one of the very few (if not the only) software that has a dedicated 1099 import functionality for Sage 50 (formerly Peachtree) with the ability to remap data to different types of 1099 forms. For example 1099 data inside Sage 50 can be in the format of 1099-MISC, W2 Mate can import the data and allow the user to remap the data to 1099-R or 1099-S and then E-File with the internal revenue service and state tax departments that require filing 1099s electronically.

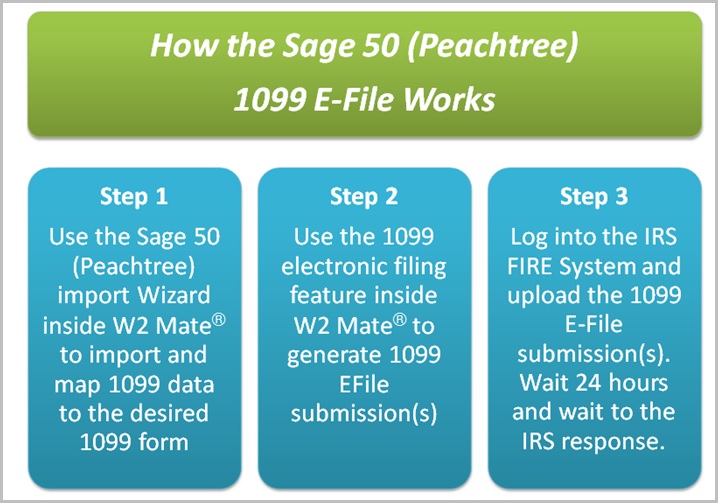

Steps:

Step 1: Use the Sage 50 (Peachtree) import Wizard inside W2 Mate® to import and map 1099 data to the desired 1099 form.

Step 2: Use the 1099 electronic filing feature inside W2 Mate® to generate 1099 E File submission(s).

Step 3: Log into the IRS FIRE System and upload the 1099 E-File submission(s). Wait 24 hours and wait to the IRS response.

Below is a summary of the steps for importing 1099 data from Peachtree software into W2 Mate:

(1) Load the 1099 Vendor Report inside Peachtree and then add all the required fields on the report by selecting the Columns button.

(2) Copy the 1099 Vendor Report Data to a Microsoft Excel Spreadsheet.

(3) From inside Microsoft Excel save the report data as CSV (Comma Delimited) file.

(4) Load the CSV file created in the previous step inside W2 Mate software.

(5) W2 Mate will read the CSV file and display the 1099 data to be imported in a spreadsheet view. You review the data and command W2 Mate to do the actual import.

The estimated time for importing the data, generating the 1099 electronic submission file and uploading to the IRS is 30 minutes maximum. As you process more companies, this time gets reduced significantly.

Although Peachtree (Sage 50) natively supports only 2 or 3 types of 1099 forms, W2 Mate supports more than 13 types including:

The following states participate in the combined federal state filing program: Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, District of Columbia, Georgia, Hawaii, Idaho, Indiana, Iowa, Kansas, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Jersey, New Mexico, North Carolina, North Dakota, Ohio, South Carolina, Utah, Vermont, Virginia and Wisconsin.

Other states that do not participate in the CF/SF program are supported through direct 1099 e-file with the state DOR. Examples of these states include Illinois, New York, Oregon and West Virginia.

If you are interested in testing how the Sage 50 1099 E-File works using W2 Mate software you can download free trial from the this link. Please note that W2 Mate is desktop-based and not hosted in the cloud, so 1099 data is stored locally on your machine where you know it will be safe from online threats. This solution is ideal for accountants and CPAs processing large volumes of 1099 returns for different clients.

© Copyright 2014 Real Business Solutions. All Rights Reserved. Please review our privacy statement and terms of use. Uninstall Instructions